child tax credit october 2021

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty researchers.

. The changes in 2021 increased the credit to 3600 per child under six and 3000 for each child six to 17Furthermore the whole amount. We explain the key deadlines for child tax credit in October. Although the Child Tax Credit CTC has reverted to its original amount of 2000 per child for.

If a taxpayer wont be claiming the child tax credit on their 2021. IR-2021-201 October 15 2021. So parents of a child under six receive 300 per month and parents of a child six or.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The Child Tax Credit Update Portal is no. Most families are eligible to receive the credit for their children.

The child tax credit check is now up to 3600 for eligible children under age 6 and 3000 for kids between ages 6. October 14 2021 726 AM MoneyWatch. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

But things are different in 2021. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. 3000 for children ages.

The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. 3600 for children ages 5 and under at the end of 2021. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per.

Written By Barbara Lantz. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. October 26 2022 1256 PM.

File Your Taxes By October 17 to Claim Your 2021 Deduction. The Child Tax Credit is a tax benefit to help families who are raising children. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

The Child Tax Credit Update Portal is no longer available. 150000 for a person. COVID Tax Tip 2022-166 October 31 2022 More than nine million people may qualify for tax benefits but didnt claim them by filing a 2021 federal income tax return.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. Your payment will be mailed to you or deposited into your bank account if youre signed-up for direct deposit. How much is the Child Tax Credit for October 2021.

Child Tax Credit. Couples making less than 150000 and single parents also called Head. The Child Tax Credit reached.

15 is a date to watch for a few reasons. Payments will be issued automatically starting November 4 2022. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

Most of us really arent thinking tax returns in mid-October. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. All eligible families could receive the full credit if they earned up to 150000 for a married couple or 112500 for a family with a single parent in 2021 according to.

2021 Tax Filing Information Get your. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Nearly all families with kids will qualify. How Much is the child tax credit for 2021.

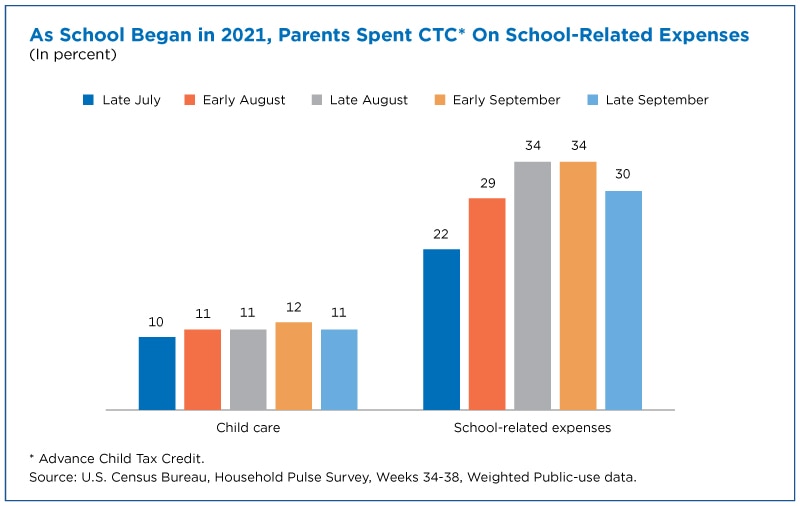

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Child Tax Credit 2021 Update Families Won T Receive Any 300 Relief Payments Unless They Act By This October Deadline The Us Sun

Expanded Child Tax Credit Contains Almost No Tax Cuts American Enterprise Institute Aei

When Is The Child Tax Credit October Opt Out Deadline 10tv Com

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

The 2021 Child Tax Credit Implications For Health Health Affairs

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

Child Tax Credit Update 2021 Parents Warned To Register For Monthly Payments Now As October Deadline Approaches The Us Sun

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities